AmericanExpress.com Redeem Line Increase – Numerous American Express cards offer strong earning rates, large welcome bonuses, and even cash discounts on acquisitions through their Amex Offers program. With a winning mixture like that, it’s little wonder that their cards are universal.

Unsuitably, strong benefits often mean stringent approval standards. There’s never an assurance you’ll get the card you wish and even the act of smearing holds a small risk.

AmericanExpress.com Redeem Line Increase

Correctly applying for a new card results in a hard pull (or inquiry) on your credit report, which can conditionally lower your credit score and make future credit applications more difficult. Significant that you have a hard chance at success might ease the anxiety that comes with this choice.

Pre-approval, while not an authorized commitment, is the only way to know you’re a qualified applicant. If you’ve received one of these offers, American Express is representing that they consider your credit well-intentioned and a respected customer, giving you an above-average chance of approval. If you want to know more about American Express Redeem Line Increase then read this article carefully.

What are the Benefits of An Increase in one’s available credit at AmericanExpress.com Redeem Line Increase?

For starters, the recipient of the rise gets to bask in the numerous rewards associated with more overall purchasing power (never know when it’s going to be needed!).

In addition to the added spending limits, a boost to a credit line can also offer indirect benefits such as a possible credit score increase.

With all of that being put out there, those who have established a mail offer from American Express might want to consider visiting www.americanexpress.com/redeemlineincrease to start the process of upping the current limit of a card.

AmericanExpress.com Redeem Line Increase: First Steps

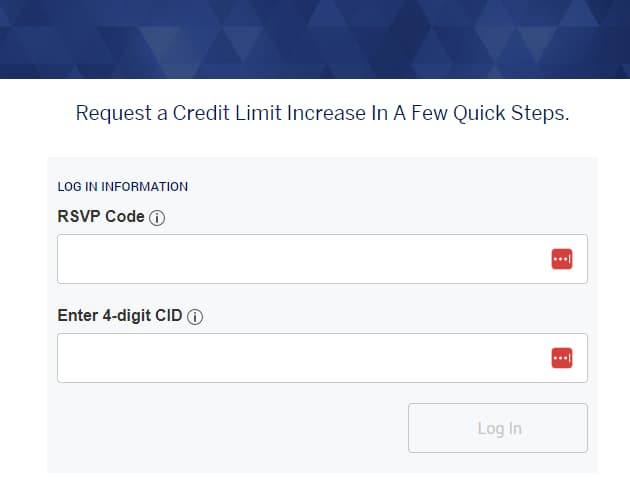

If you wish to get started with the line increase offer, the RSVP code shown on the correspondence needs to be entered along with the four-digit CID number (most American Express customers know by now that the CID is situated on the FRONT of the card).

Here are the cards You Won’t Need to Increase at AmericanExpress.com Redeem Line Increase

- American Express Green – Possibly the most iconic of all American Express cards

- American Express Premier Rewards – Adequately of cashback but has a $195 yearly fee

- American Express Business – Kind of like the Premier Rewards but for industries

- American Express Platinum – An astonishing card for those who plan on lots of travel

- American Express Centurion – The most special card from Amex is INVITE ONLY

AmericanExpress.com Redeem Line Increase – Customer Service

Questions about the procedure of redeeming a line increase can be addressed by clicking the Contact Us link to use the accessible live chat feature at the American Express Credit Line Increase Center.

Those who wish to skip the live chat can try calling the American Express customer service section.

American Express Customer Service Contact Information

- PO Box 981535, El Paso, TX 79998-1535

- 800-528-4800

FAQs (frequently asked questions):

-

How can you increase my Amex line?

You can simply request a credit limit increase on your personal or minor business Card by calling the number on the back of your Card or through your online account.

-

Does American Express do a hard pull for credit limit increase?

Can we get a hard pull on my credit report by requesting a credit limit increase from Amex? Usually, American Express does not do a hard pull on your credit report when you appeal a credit limit increase. Always keep in mind, however, that this is not a rule and can always change.

-

What is the RSVP code for American Express?

Your RSVP code is a single code to be used to respond to your special mail offer. It is 14 characters – one letter and 13 digits situated on your mail application.

-

How much should I request for a credit line increase?

Credit specialists suggest that you only ask for a rise when you’ve paid your bills punctually. They also mention waiting at least six months after you received the credit card and asking for no more than a 10% to 25% rise. Asking for more than 25% might raise questions about your intentions.

-

How frequently does Amex automatically increase the credit limit?

Does American Express automatically increase credit limits? American Express might automatically raise your credit limit as frequently as every six to 12 months. Though, just because you haven’t received an automatic increase doesn’t mean you’re not qualified. You should reach out to American Express to see if you succeed.

-

Will Amex increase my limit automatically?

Certainly, Amex increases credit limits automatically. This will happen if you have excellent creditworthiness and make all your payments on time. Paid your balances in full each month or maintaining a low credit utilization ratio might also work in your service.

-

Is the AMEX RSVP code pre-approval?

Putting in your American Express Platinum card RSVP code will not only flag your request as pre-approved but also lock in the consistent bonus offer if you are approved. If you do not receive a targeted offer, you will be able to check for pre-qualified offers on the Amex website.

-

Does Amex still have a black card?

The American Express Centurion Card is the authorized name of the Amex Black Card. The Black Card is a high-end, special charge card issued by American Express. Platinum Cardholders must meet convinced criteria to be extended an invitation. The American Express Black Card originates in personal and business variants.

Also Check:

- ActivateS3.com Login

- Cintas Partner Connect Login

- www.Lowes.com Survey

- WalGreens.Syf.com

- Verify.Syf.com

Conclusion:

We have shared everything about AmericanExpress.com Redeem Line Increase in this article if the info that we shared above helped you in any way then do share it with others.